- What is Fintech App Development?

- A Step-by-Step Guide to FinTech Product Development

- Technologies and Programming Languages Used in Fintech Development

- London Fintech Market – A Thriving Ecosystem

- Choosing the Right Fintech App Development Company in London

- How does experience matter in the Fintech app development process?

- How much does it cost to build a FinTech app?

- How long does it take to develop a FinTech app?

- Fintech Development Trends

- Emergence of AI and Robo-Advisors

- The Future of the Fintech Hub in London

- Adopting Next-Gen Advancements to Deliver Top-Notch Fintech Apps in 2025

The Fintech industry is booming and will reach $332 billion by 2025. It has revolutionised how users manage their finances and experience trading and investment.

If you are planning something in finance, we might have the perfect plan for you!

Launching a functional user application is the most lucrative avenue for penetrating the finance market. The current consumer market demands steady innovation in fintech technology with secure digital solutions. Therefore, venturing into fintech solutions demands proper guidance and advanced tech solutions.

In this financial app development guide, let us explore the essential aspects of a fintech app and how to find an ideal development partner in London.

Fintech is a vast sphere with numerous soaring technologies and digital experiences. It is tactical to identify something secure, scalable, and user-oriented.

Remember, London is a thriving and competitive fintech market, and the ideal stance is to be aware of the technological and market intricacies.

What is Fintech App Development?

Let us get down to the basics of a fintech app – a financial technology application. Fintech apps are digital tools for users to manage, transfer, or invest money seamlessly and in a secure environment.

Now, fintech applications include payment apps, banking platforms, investment processes, and even cryptocurrency trading.

So, fintech is an umbrella term for varied financial solutions designed for people. Fintech app development creates mobile fintech apps for users and their financial needs. The applications utilise various programming languages and API structures to create a secure finance ecosystem with optimum data protection.

The present fintech industry and development strategies expand into multiple domains and subdomains. For instance, we can experience AI support and data science manipulations across various applications. It makes digital finance easier, relevant, user-focused, and accessible from an extensive learning curve.

The Fintech Industries –

There are multiple types of fintech industries, and here is how each functions in the market –

- Fintech Banking – It entails all banking services, including account creation, card management, secure transactions, and more. An effectively developed fintech banking app ensures users experience smooth financial services.

- Digital Payments—The present era is all about quick and error-free transactions. Thanks to innovations and upgraded regulations in fintech development, online transactions are secure and safe, and user data is protected at multiple levels.

- PFM or Personal Finance Management—PFMs offer consolidated access to all your financial accounts in one platform. This includes payments, investments, insurance, and more, making it easy to manage your financial aspects in one go.

- Wealth Management Solutions – These user-friendly platforms help manage assets and investments and aid growth through expert advice.

Apart from these, several fintech software solutions make user lives easy and convenient through effortless financial management. Whichever fintech startup ecosystem you decide to launch, ensure it is user-focused and makes daily financial activities effortless.

Key Features of a Fintech App

As a classic fintech app development guide, discussing the various features of a modern fintech application is mandatory.

While there are numerous features to prioritise and discuss, here are the necessary aspects –

- Security and compliance (data encryption, authentication).

The first considerable factor regarding fintech applications is security and a fraud-free platform. Since unethical activities are on the rise in this digital era, advanced financial data protection, in addition to traditional safety measures, is crucial.

If you are launching your first Fintech application, prioritise cutting-edge safety solutions like data encryption and authentication. Data encryption is a fundamental aspect of cybersecurity foundations and protects sensitive customer data from authorised entry. Similarly, multiple forms of authentication are applicable to fintech app development. The appendages range from biometrics to two-factor authentication and firewalls to code obfuscation.

- User-friendly interface.

How a user perceives the app and its overall usage is essential and should be considered. The fintech app’s UX must be compelling, smooth, and have seamless navigation.

An attractive app flow helps increase product adoption, improve custom engagement and increase organic traffic. In a user-friendly fintech solution, customers must find it easy to sign up, make financial decisions and experience a secure gateway.

- Integration of payment gateways.

Since a fintech app’s core functionality revolves around financial transactions, seamless integration with various payment gateways is essential. This ensures users effortlessly conduct payments using preferred methods, such as credit cards, debit cards, digital wallets, or even cryptocurrency.

When selecting payment gateways, consider transaction fees, security protocols, and global reach. Ensuring compatibility with multiple currencies and regions broadens the app’s user base and enhances brand popularity.

- AI and machine learning capabilities.

With the emergence of artificial intelligence and machine learning, there is an optimum possibility of enhancing the capabilities of a fintech app.

These technologies help the application analyse vast amounts of data. It eventually provides valuable insights, detects fraud patterns, and offers personalised recommendations.

For instance, AI can assess creditworthiness, predict market trends, and automate customer support tasks. Additionally, ML algorithms can learn from user behaviour and preferences to tailor the app’s features and recommendations. These features contribute to an elevated fintech app user experience and increasing organic traffic.

- Personalised customer experiences.

Providing personalised customer experiences is crucial for fintech app success. Data analytics and user behaviour tracking help offer tailored recommendations, notifications, and content to the customer base.

It enhances user engagement and deeply understands individual needs and preferences.

Personalisation can be achieved through features like personalised dashboards, targeted marketing campaigns, and customised product offerings.

A Step-by-Step Guide to FinTech Product Development

Developing a successful fintech product requires a meticulous and strategic approach. While we have discussed the necessary features of a fintech app, the development process ensures each feature is in an optimum state and designed for users.

This fintech app development guide section outlines the primary steps involved in the product deployment process, from idea validation to in-depth maintenance.

1. Idea Validation and Market Research

The first step in fintech product development is to validate the idea and conduct thorough market research. Market research ensures you know the public expectations and what the industry lacks.

The process involves identifying a specific problem the product aims to solve, understanding the target market, and assessing the competitive landscape.

Conduct market surveys, analyse industry trends, and identify potential competitors to ensure the product offers a unique value proposition. A fintech application that resolves a specific concern, and no other competing app does it, is sure to be a market success.

2. Planning and Choosing the Right Tech Stack

Once the idea is validated, the next steps are to plan the development process and select the appropriate technology stack.

It includes defining the product’s features, creating a detailed roadmap, and choosing the programming languages, frameworks, and suitable tools.

Consider factors like scalability, security requirements, and integration with existing systems when making technology choices.

We recommend consulting professionals in fintech app development in London.

3. Designing the App (UX/UI)

A well-designed user interface and user experience is crucial for any fintech product. Prioritise investing in creating a visually appealing and intuitive interface that is easy to navigate and user-friendly.

Pay attention to details such as colour schemes, typography, and layout. Conduct usability testing to gather feedback and make necessary improvements.

The product presence must have a low learning curve to avoid user abandonment. The easy navigation contributes to elevated exploration.

4. Development Process (Frontend and Backend)

The development process involves building the fintech product’s front and back end fintech products. The front end is what users interact with, while the back end handles the underlying logic and data storage. Choose experienced developers with expertise in fintech-specific technologies and frameworks. Collaborate closely with the development team to ensure the product meets your requirements and adheres to finance industry best practices.

5. Testing for Security and Performance

Thorough testing is essential to identify and fix any bugs or security vulnerabilities before launching your fintech product.

Conduct various types of testing, including unit testing, integration testing, and user acceptance testing. Pay particular attention to security testing for advanced sensitive user data protection. Utilise tech tools and techniques to assess performance and ensure the product can handle expected loads and modern transaction concepts.

6. Deployment and Maintenance

Once the testing phase is over, it is time to launch the fintech app in the market. Choose a suitable deployment environment, such as a cloud platform or on-premises servers.

Monitor the product’s performance and address issues that may arise for the professionals. Continuously update and maintain the application to ensure it remains relevant and secure.

Experts curate the steps mentioned in this fintech app development guide to increase the chances of developing a successful fintech app that meets the target market’s needs.

Technologies and Programming Languages Used in Fintech Development

The fintech industry is rapidly evolving and driven by technological advancements. Developers utilise a variety of programming languages and technologies to create innovative and efficient fintech solutions.

Let us explore some of the most popular choices in the fintech landscape.

Popular Programming Languages –

- Python: Python’s versatility, readability, and extensive libraries make it a popular choice for fintech development. It is well-suited for data analysis, machine learning, and backend development.

- Java: Java’s robustness, scalability, and security features make it a reliable choice for enterprise-level fintech applications. It is used for building financial systems, trading platforms, and payment gateways.

- Kotlin: As a modern programming language for the JVM, Kotlin offers concise syntax, interoperability with Java, and improved developer productivity. It has gained popularity in fintech for its ability to create efficient and maintainable code.

Emerging Technologies –

- Blockchain: Blockchain in Fintech provides a decentralised, secure, and transparent way to record transactions. It can revolutionise the financial industry by enabling peer-to-peer transactions, smart contracts, and supply chain management.

- Artificial Intelligence (AI): AI in financial services can automate various tasks in fintech, such as fraud detection, customer service, and investment analysis. Machine learning algorithms can analyse vast amounts of data to identify patterns and make predictions.

- Machine Learning: A subset of AI, machine learning involves training algorithms to learn from data and improve their performance over time. It is used in fintech for credit scoring, risk assessment, and personalised financial recommendations.

APIs for Integration –

- Open Banking APIs: APIs allow third-party tools to access customer financial data with their consent. They enable the creation of innovative fintech products and services, like budgeting tools, personal finance management apps, and payment solutions personalised for the masses.

- Payment Gateway APIs: Payment gateway APIs facilitates the integration of payment processing capabilities into fintech applications. They provide secure and reliable ways for users to make payments using various methods, including digital wallets.

- Financial Data APIs: Financial data APIs provide access to market data, financial news, and economic indicators. They are essential for building investment platforms, trading applications, and financial analysis tools.

Leveraging these technologies and programming languages helps fintech developers create innovative and scalable solutions addressing the evolving needs of the financial industry.

As technology advances, we may expect exciting developments in fintech.

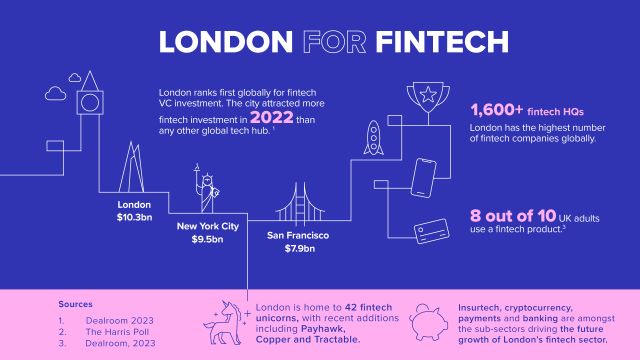

London Fintech Market – A Thriving Ecosystem

London has emerged as a global fintech hub, attracting global entrepreneurs, investors, and talent. Several factors contribute to its prominence as a fintech hotspot.

- The UK government has implemented favourable policies and initiatives to foster fintech innovation. It includes tax incentives, regulatory sandboxes, and funding programs encouraging the growth of fintech startups.

- London boasts a large, skilled workforce with expertise in finance, technology, and entrepreneurship. The talent pool is essential for developing cutting-edge fintech solutions for the growing market.

- The city is home to numerous fintech accelerators, incubators, and co-working spaces, which provide support and resources to the fintech startup ecosystem and facilitate collaboration, networking, and knowledge sharing among entrepreneurs.

- London’s strategic location and international connections make it an attractive destination for fintech companies seeking to expand their reach. The city’s position as a financial centre provides easy access to global markets and customers.

While regulations are essential for consumer protection and market stability, they can pose challenges for fintech startups. The UK government has taken steps to balance regulation with innovation, creating a conducive environment for fintech growth.

It all comes down to selecting the perfect team of fintech development experts who can create the ideal, scalable finance application for the modern market.

Choosing the Right Fintech App Development Company in London

Selecting the ideal fintech app development company in London is crucial for the success of your project. With numerous options available, consider several factors when making your decision.

This fintech app development guide takes you through the essential criteria to find the best with the talent pool.

- Experience and Expertise: Look for a company with a proven track record in fintech app development. Experience in the financial industry demonstrates a deep understanding of the sector’s unique challenges and regulations.

- Technical Skills: Ensure the development company has the technical expertise to handle your project. It includes proficiency in relevant programming languages, frameworks, and technologies.

- Security and Compliance: Fintech applications deal with sensitive financial data. Choose a company that prioritises security and adheres to industry standards and regulations, like GDPR and PCI DSS.

- Project Management Capabilities: A well-organised and experienced project management team is essential for delivering projects on time and within budget. Look for a company with effective project management methodologies and communication channels.

- Scalability and Flexibility: As your business grows, your fintech app may need to scale to accommodate the increasing demand. Consider a company that adapts to your changing needs and provides scalable solutions.

- Communication and Collaboration: Effective communication and collaboration are crucial for a successful partnership. Choose a company that values open communication and is willing to work closely throughout development.

- Client References: Ask for references from previous clients to get a sense of the company’s reputation and the quality of their work. You can also consider exploring the various reviews and testimonials for a deeper insight.

How does experience matter in the Fintech app development process?

Experience in this specific domain is invaluable for fintech app development. A company with a track record in this industry understands the requirements, regulations, and challenges associated with financial applications. They are more likely to –

- Deliver solutions that meet industry standards. Experienced companies are familiar with the regulatory landscape and ensure the app complies with all relevant laws and regulations.

- Understand the nuances of financial transactions. They deeply understand the intricacies of financial transactions, payment processing, and data security.

- Provide tailored solutions. Based on their experience, they can offer tailored solutions addressing the unique needs of the fintech business.

Custom Solutions vs. Off-the-Shelf Software

When choosing a fintech app development company, you may choose a custom solution or off-the-shelf software.

Each approach has its advantages and disadvantages –

Custom Solutions are –

- Tailored to your needs and business requirements, ensuring the app meets unique goals.

- Flexible and offers more control over the app’s features and functionality, allowing you to adapt it as the business evolves.

- Competitively active with unique features and capabilities.

Off-the-shelf software is –

- Pre-built and implemented more quickly than custom solutions, allowing you to launch the app sooner.

- Quicker with lower development costs compared to custom development.

- Risk-free, as the software has already been tested and used by other businesses and every challenge is professionally dealt with.

The best choice for your fintech app development depends on your needs, budget, and timeline. Carefully consider the factors outlined to select a company that can help you achieve your business goals.

How much does it cost to build a FinTech app?

The cost of developing a fintech app varies significantly depending on several factors. This fintech app development guide helps understand these factors, estimate the costs involved in different stages of development and make informed decisions.

Factors Influencing Development Costs –

- Complexity: The complexity of your fintech app directly impacts the development costs. Apps with intricate features, integrations, and user interfaces require more time and resources.

- Features: The number and complexity of features influence the cost. Apps with advanced functionalities like real-time payments, AI-powered recommendations, or blockchain integration are expensive to develop.

- Technology: The choice of technology stack affects the development costs. Using cutting-edge technologies or complex frameworks increases the price due to the specialised skills on board.

- Third-Party Integrations: Integrating with third-party services like payment gateways, data providers, or APIs increases development costs.

Estimation of Different Stages –

- Design: The design phase involves creating wireframes, mockups, and user interfaces. Costs vary depending on the level of detail and complexity of the design.

- Development: The development phase involves building the app’s backend and front end. Costs depend on the complexity of the features, the chosen technology stack, and the hourly rates.

- Testing: Thorough testing is essential to ensure the app’s quality and functionality. Costs vary based on the scope of testing, including unit testing, integration testing, and user acceptance testing.

Providing exact cost ranges without specific details about a project is challenging. However, here are some general estimates that offer an approximate idea for you before you begin –

- Basic fintech app: 50,000 – 100,000 GBP

- Mid-sized fintech app with moderate complexity: 100,000 – 250,000 GBP

- Complex fintech app with advanced features and integrations: 250,000 GBP or more

It is critical to note that these are just estimates, and the actual costs vary significantly. Quotes from multiple development companies should be obtained for a more accurate understanding of the project’s costs.

How long does it take to develop a FinTech app?

Similar to development cost, the timeline for a fintech app varies significantly due to its complexity, features, and the specific requirements of the project.

A simple fintech app with basic features, like a personal finance tracker or a currency converter, typically takes 3-6 months to develop. These apps involve less complex development and require less integration.

Complex fintech apps with advanced features like payment gateways, investment platforms, or blockchain-based solutions may take 6-12 months or longer to develop. These apps involve more extensive development, testing, and integration efforts.

Apart from these, other aspects affect the development duration –

- Custom Features: The number and complexity of custom features significantly impact the development timeline. Apps with highly customised features or integrations require more time to develop and test.

- Security Needs: Fintech apps often deal with sensitive financial data, prioritizing security. Implementing robust security measures reduces development time and involves additional testing and compliance requirements.

- Third-Party Integrations: Integrating with third-party services extends the development timeline. These integrations require additional configuration, testing, and ongoing maintenance.

- Team Size and Experience: The size and experience of the development team affect the development timeline. A larger and more experienced team complete the project faster, while a less experienced squad require more time.

- Iterative Development: Adopting an iterative development approach, where features are developed and tested in stages, helps reduce the overall development time and ensures the app meets the desired requirements.

We recommend open communication with the development team and regular project reviews to stay informed about the progress and make any necessary adjustments.

Fintech Development Trends

The fintech industry constantly evolves, driven by technological advancements and changing consumer preferences. Let us explore some emerging trends shaping the future of the fintech app experience.

Rise of Blockchain and Cryptocurrency Solutions

Blockchain technology has gained significant traction in recent years. The decentralised, secure, and transparent way to record and verify transactions is worthwhile. The technology is applied to various areas of fintech, including –

- Cryptocurrencies: Bitcoin, Ethereum, and others have gained widespread attention as alternative currencies and investment assets. They leverage Blockchain technology to facilitate secure and decentralised transactions.

- Smart Contracts: Smart contracts are self-executing contracts with terms directly written into code. They automate various financial processes, such as payments, settlements, and asset transfers.

- Tokenisation: Tokenisation involves representing assets, like real estate or securities, as digital tokens on a Blockchain. It facilitates fractional ownership, improves liquidity, and reduces transaction costs.

Emergence of AI and Robo-Advisors

Does fintech include AI? Yes, it does and adds to the streamlined aspect.

Artificial intelligence is transforming the way financial advice is delivered. AI-powered financial advice platforms, or robo-advisors, provide personalised investment recommendations and portfolio management services.

These platforms leverage algorithms and data analytics to analyse client risk profiles, market trends, and investment opportunities.

- Increased Focus on Data Privacy and Compliance

Data privacy and compliance have become increasingly vital in the fintech industry. Regulations like the General Data Protection Regulation (GDPR) have raised the bar for data protection and require businesses to handle customer data responsibly.

Fintech companies must invest in robust security measures and implement data governance frameworks to protect sensitive information and comply with regulatory requirements.

- Biometric Authentication

Biometric authentication, like fingerprint or facial recognition, is becoming common in fintech applications, providing enhanced security and convenience for users.

- Regtech

Regtech refers to using technology to help businesses comply with regulatory requirements. Regtech solutions automate compliance processes, reduce costs, and improve efficiency.

As the fintech industry evolves, we can expect to see more innovative and disruptive solutions emerge. It is critical to stay informed of these emerging trends so that fintech companies can position themselves for success and capitalise on the opportunities.

The Future of the Fintech Hub in London

London’s position as a global fintech hub is expected to strengthen further. From the UK government’s commitment to fostering innovation in financial technology to an intense pool of expert developers, the future is poised to thrive and evolve with technological advancements.

AI will play an increasingly vital role in fintech, enabling tasks such as fraud detection, personalised financial advice, and automated underwriting. Similarly, Blockchain technology will continue to disrupt traditional monetary systems.

We can expect cloud-based solutions to help fintech companies to scale their operations efficiently and reduce costs.

London’s vibrant ecosystem is here to scale appropriately in the finance sector with impressive digital solutions backed by revolutionary technical ripple.

Adopting Next-Gen Advancements to Deliver Top-Notch Fintech Apps in 2025

We are at the end of this fintech app development guide and explore various aspects of developing premium fintech solutions for the market.

As discussed, choosing a skilled fintech app development company in London is vital to capitalising on experience and a proven track record.

Prioritise market research before venturing into the finance sector. Understand the market and what the user demands to deliver ultimate solutions bound for success.

This fintech app development guide has uncovered several mandatory aspects for an effortless development process. Understand the vitality of bespoke finance solutions and one that resonates with the target audience.

Consult with the top fintech experts at Webskitters Ltd. to grasp the presence market and the winning app development strategy. Our team of experts has a proven track record of delivering optimum technical solutions, regardless of your financial niche.

Have a fintech solution in mind? Allow us to help you!